The Challenge of Market Forecasting

Tactical portfolio shifts are often driven by market views aimed at reducing risk or capturing opportunities. History shows, however, that such views are frequently wrong or poorly timed, making tactical adjustments less effective than expected.

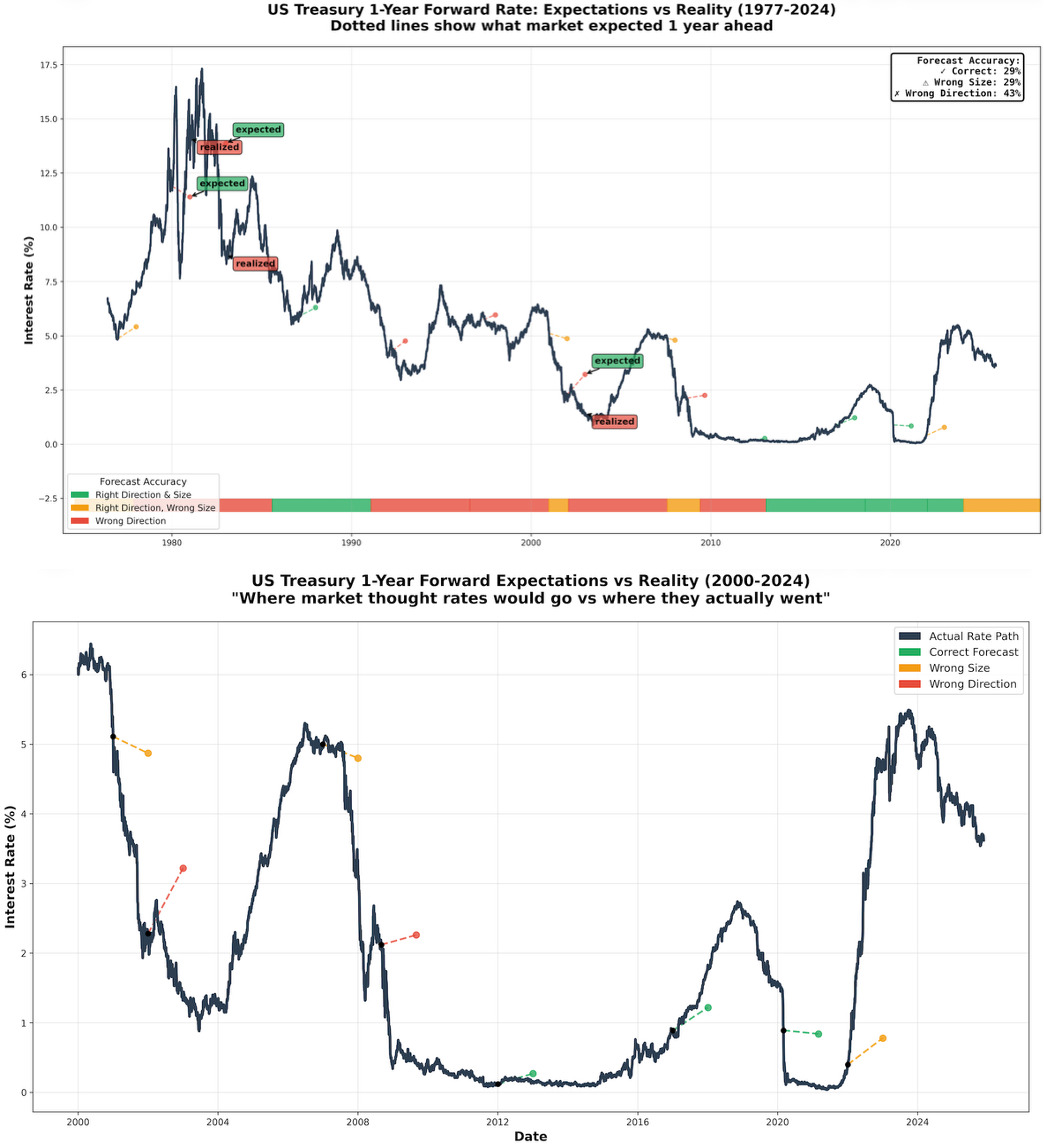

The chart below compares market expectations for future interest rates with actual outcomes over more than 25 years, showing that forecasts were correct only about 35% of the time. This exposes a key weakness of view-driven portfolio management.

The SATID methodology addresses this by validating views through systematic cross-asset analysis, limiting unintended outcomes. As Nobel laureate Daniel Kahneman demonstrated, investors consistently overestimate what they know and underestimate uncertainty and risk.